Today we look at Orion Office REIT, a U.S.-based real estate investment trust traded on the New York Stock Exchange. Our stock is traded on the NYSE under the symbol ONL., the ONL stock A.K.A Orion REIT stock.

Orion Office REIT’s official website is onlreit.com

Orion specializes in acquiring and managing a diversified portfolio of office properties, primarily in suburban areas.

Read more about Best REITs to invest in 2023

Table of Contents

- Who did Orion office REIT spin-off from?

- Orion office REIT revenue

- Why is Orion Office REIT focusing on suburban net lease office properties?

- What competitive advantages does Orion Office REIT have versus other bidders?

- Orion Office REIT Portfolio

- What does Orion office REIT do?

- Key value creation drivers to super growth

- Does Orion REIT pay a dividend?

- Orion office REIT buy or sell

Who did Orion office REIT spin-off from?

That’s the key part: they’re based on a single-talent lease, similar to Stag Industrial,

meaning a single tenant occupies the building.

net leases with investment-grade and non-investment-grade tenants.

they have a total of 91 properties with an occupancy rate of 86.7 percent in 2021.

The company was formed through a spin-off from Realty Income and a merger in 2021 that created Orion Office Reit,

An internally managed real estate investment trust engaged in the acquisition and management of office properties headquartered in high-end suburbs throughout the United States.

Orion office REIT revenue

The company had total revenues of $135 million and a net income of $5.6 million.

As noted above, the Orion portfolio consists of 91 properties,

focused on suburban office buildings with a tenant in the United States.

As can be seen here, after the pandemic, the company has an incredible occupancy rate of 86.7,

which is very remarkable because the average remaining lease term is 4.1 years.

most of the company’s portfolio is located in the sunbelt markets of the United States. The percentage leaders are Texas at 14.3 percent, New Jersey at 11.2 percent, and New York at 7.9 percent.

Why is Orion Office REIT focusing on suburban net lease office properties?

According to the company, macroeconomic and demographic trends point to a positive outlook for suburban office properties. In recent years, de-urbanization has led to a shift in population away from gateway cities to smaller primary,

and secondary markets and non-urban communities,

While major corporations continue to announce relocations and/or new corporate locations in the suburbs –

people are increasingly choosing to live in the suburbs and many employers are moving there as well.

The company believes this trend has been accelerated by the pandemic.

In addition, Orion Office REIT has a seasoned leadership team with significant experience,

in the sector and a proven ability to create value through asset management, capital recycling, and external growth.

The company pursues a differentiated strategy as the only net leasing REIT of suburban office properties and has a high-quality portfolio with a high proportion of investment-grade leases and many corporate headquarters and mission-critical office properties.

What competitive advantages does Orion Office REIT have versus other bidders?

Orion Office REIT’s competitive advantages include significant liquidity,

a conservative balance sheet and a highly experienced management team with a successful history operating publicly-traded REITs,

Significant expertise in the U.S. suburban single-tenant office markets,

and extensive relationships with industry participants, combined with the company’s vertically integrated platform that handles investment, financing, property management, and leasing.

Orion Office REIT Portfolio

Let’s take a look at Orion’s portfolio. The company isn’t in every state in the U.S., but it’s in some, most notably Texas.

Their tenants are government service providers like Walgreens and T-Mobile

We can also see which industries they belong to.

Their portfolio is also quite robust and diversified with high-quality tenants, as seen here in the top 10 industries that make up their portfolio.

they focus on four main industries: Healthcare and equipment services with 12.8 percent,

Government and public services with 12.7 percent, insurance with 9.8 percent, and financial institutions with 9.6 percent.

if we look at the tenant mix, the largest portion of the portfolio is the Government Services Administration at 12.4 percent, Merrill Lynch at 7.1 percent, and Highmark Western New York at 4.9 percent, Highmark being an unrated tenants, but Lynch and GSA are investment grade tenants.

other names include T-Mobile, Cigna, Walgreens, and even Tava Pharmaceuticals.

What does Orion office REIT do?

when Orion is considering an acquisition or reviewing tenants, the Company looks for stable cash flows from long-term leases with tenants of high credit quality. As noted above, the Company seeks investment-grade and non-investment-grade tenants that have high credit ratings based on independent underwriting.

they also focus on companies and facilities in economic sectors with strong growth and emphasize long-term leases with an average term of 8 to 12 years.

In addition to their rental criteria, they also offer triple-net leases, double-net leases, and modified gross leases with annual base rent increases in line with industry standards.

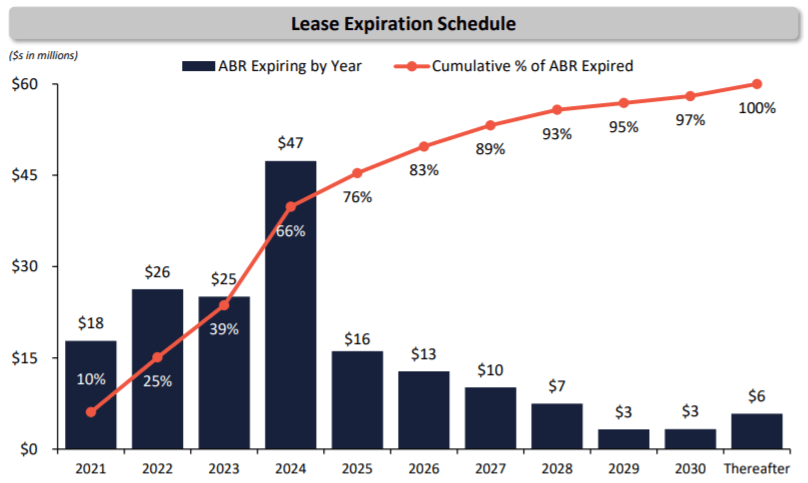

The timeline (above image) for the expiration of the lease and how the company plans to generate little to no revenue.

in 2023 and 2024, the majority of leases expire, after which the percentage decreases. The company’s plan to maintain annual renewals is to build a relationship with lessees and pool their leasing expertise to complete leases sooner, resulting in less turnover and more flexibility.

also highlights the company in some of the top target markets, which are a catalyst for future growth not only for the company but for office space in general.

these cities include Phoenix, Dallas, Fort Worth, San Diego, and even Atlanta.

Key value creation drivers to super growth

In addition, management has highlighted its growth factors. It seeks to generate growth through three main categories: active asset management, i.e., its expertise in leasing, landlord relations and cost reduction, and portfolio optimization through capital recycling with a view to acquisitions and external growth.

Does Orion REIT pay a dividend?

The company has also just started paying a dividend, which was declared in the first quarter of 2022. A quarterly dividend of 10 cents per share will be paid, and with continued implementation, this company could be well on its way to future dividend increases.

Orion office REIT buy or sell

Cons

The logic behind the sale was that people are now more comfortable than ever working from home, so companies are trying to cut costs by downsizing their offices or switching entirely to remote work, since renting an office can cost a large sum of money.

In an interview with the new management of the Orion office with Brad Thomas a riding specialist from IREIT on alpha, we can learn a little more about the company after the spinoff

Here are the most important things from the interview:

First, Orion office management moved to the new company rather than being laid off.

Second, the quality of Orion office’s capital management and operations is very high, and its office tenants are in key sectors where job cuts are less likely.

The top 10 largest industry is health care, followed by telecommunications, insurance, financial services, government services, drugstores, hardware stores, manufacturing, energy, and manufacturing. Many of these industries are growing or unlikely to shrink.

The largest tenant is the Government Services Agency, followed by Bank of America and Merrill Lynch. Most tenants have very high credit ratings, which means they’re unlikely to default on their payments

so for me, the inability to pay is less of a problem than the company’s willingness to downsize.

The final takeaway is that, given the constraints of office real estate, the AFFO payout is generally likely to be a sustainable 55 percent, implying a return of between five and eight percent.

Pons

When the dividend is paid, it’ll attract many investors, especially if it’s at the higher end of the scale.

With interest also comes the indexes that the company is including, such as ETFs, etc.

This means that the price can potentially go up as well, and a high initial yield on the cost is likely due to the payment schedule for renting the office buildings versus retail buildings that Realty Income deals with.

One concern is that most leases are up for renewal and renegotiated over the next four years, giving some companies the ability to leave if they so choose.

that could be a threat, but then again, it’s not exactly easy to move an entire office to another building just to get cheaper rent.

I don’t think office space is necessarily a growing industry, but rather could be a top player in the office route sector and will be more of an income play.

hope you learn something new about Orion office REIT.