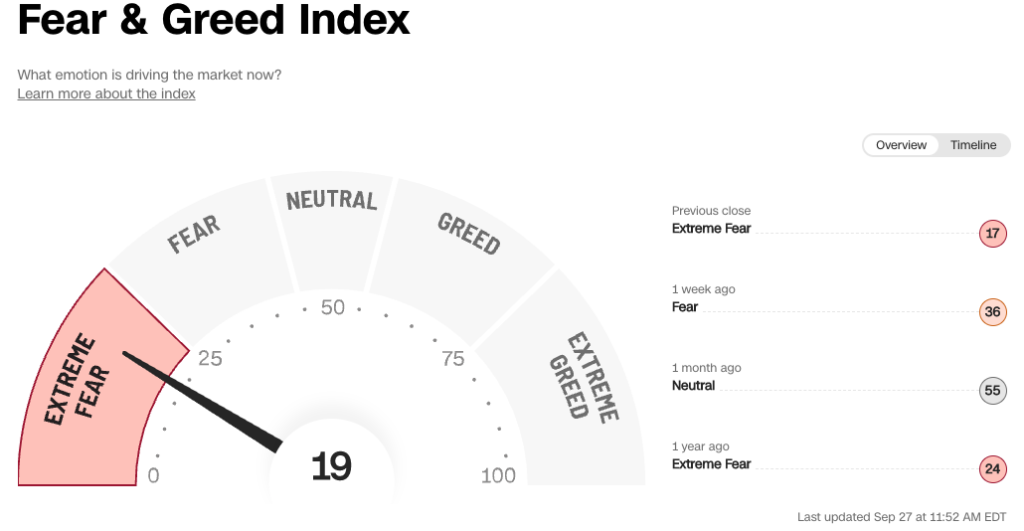

What happens to interest rates during a recession, the fear of recession is mounting in the United States. Where do you peg the probability of it?

Right now? Let’s say by year-end, I’d say about 50/50. It’s pretty close. In 2022, the World Bank slashed its global growth forecast to 2.9%. warning that several countries could fall into recession.

I think there’s a lot of fear just around how it’s going to play out.

I think the pain tends to be kind of concentrated in the victims of the recession. But none of us can be completely sure, that our families are not going to be among those victims.

Table of Contents

- Recessions are really inevitable.

- Recessions are part of the American economy?

- Are we in a bubble stage?

- Unpredictable event

- Recession is part of our business cycle

- The Federal Reserve could have done better.

- Can we do a soft Landing?

- Signs of a 2022 recession, what happens to interest rates during a recession

- How to protect your portfolio

- Should you be a stockpicker when a recession occurs?

- Dynamics of a 2022 recession

Recessions are really inevitable.

Recessions often impact the valuation of other asset classes. like the value of your house, the value of your car, and last but not least, the increase in the unemployment rate.

where people really fear that they could lose a job and thus lose income.

I do believe the 2022 recession is really inevitable. I believe that the economic cycle exists. But some believe that this isn’t all bad news. Some investors, look at recessions as opportunities.

This is an opportunity to buy this asset that’s now on sale and now it’s at fair value. I think it’s really important to just understand the mechanics.

knowledge is power, information is power, and then you can start to be able to seize the moment.

Recessions are part of the American economy?

So why do recessions happen and are they an inevitable part of the American economy?

The National Bureau of Economic Research defines a recession – as a significant decline in economic activity. that’s spread across the economy and lasts more than a few months.

It’s been synonymous with major economic pain felt by businesses and consumers alike. The Congressional Research Service cites three main causes of a recession.

The first is an overheated economy. When economists talk about the economy overheating, they mean that demand in the economy is growing faster than the ability of the supply side of the economy to satisfy it.

And that can be because we just can’t produce enough stuff, or it can be because we don’t have enough workers. A hot spike in inflation alongside a dip in the unemployment rate could signal that the economy may be overheating.

Every recession but one since World War II has seen an inflation hike right before the start of the downturn. And nearly every recession since World War II saw the unemployment rate fall to 5% or lower.

When unemployment gets really low, it means that there are not really very many available workers for firms to hire. And if firms can’t find workers to hire, then they have to start bidding up wages. As they start paying people more, people have more income with which to buy goods and services.

More income from buying goods and services tends to push up the prices of goods and services.

So you get positive feedback between wages moving higher, pushing prices higher, pushing wages higher, pushing prices higher. And if the Federal Reserve didn’t intervene by inducing a recession and raising interest rates, that spiral would get stronger and stronger and stronger. And eventually, you’d have inflation running away and really getting out of control.

Are we in a bubble stage?

Asset bubbles can be another direct cause. The recession of 2001 was primarily caused by the dot-com bubble burst of 2000, while the Great Recession occurred just after the crash of the housing market.

Asset prices, whether they’re stock prices or house prices, go up a lot, and they exceed the fundamentals, and then suddenly they come down abruptly.

That has a big negative effect on the economy, particularly if people have borrowed to buy those assets. When that happens, people find out that they’re not as wealthy as they thought that they were. And when you find out that you’re not as wealthy as you thought that you were, you cut back on your spending.

And as you cut back on your spending, that decreases demand in the economy, and it slows the economy down, and then enough of it can cause a recession.

Unpredictable event

At other times, recessions are caused by unpredictable events that lead to severe disruptions. Economists call these events black swans.

These are the things that, unfortunately, we can not manage. You cannot control geopolitical events. You cannot control COVID-19. But when they do happen, usually they’re fast and furious and have an immediate impact.

And that’s what drove us into a very quick recession throughout COVID and others that we’ve seen through the course of time.

The U.S. has experienced at least 30 recessions throughout history, dating back as early as 1857.

They may have become an inevitable part of the economic cycle that fluctuates between periods of expansion and contraction. History teaches us that recessions are inevitable.

Recession is part of our business cycle

I do think recessions are part of our business cycle. Do I believe that they’re completely inevitable in a capitalistic society? Partly.

There are so many events and external factors that contribute to recessions, such as supply shocks, demand shocks, and geopolitical issues that come about.

It’s part of human psychology to get too excited about things. And when you get too excited about things, you ultimately have asset bubbles and those ultimately lead to recessions.

It’s also part of human nature that people will continue expanding their firms and businesses as long as the economy is good. And as long as that keeps happening, you’ll eventually overheat, which eventually will lead to a recession.

The Federal Reserve could have done better.

Nonetheless, certain measures can be taken to make recessions less likely. As the nation’s authority on monetary policies, the Federal Reserve plays a critical role in managing recessions.

With the right monetary policies, the Fed can prevent a recession. It’s just very difficult to do so. There are two things that the Fed can do to avoid a recession.

One is to steer the economy so we don’t get so much inflation that they have to slam on the brakes.

The second is to pay close attention to the financial system so we don’t have a repeat of the 2007, 2008, and 2009 recessions, which were caused by too much lending, too many mortgages, and too much careless securitization on the part of Wall Street.

The Fed has often attempted to avoid a recession by engineering what’s known as a soft landing.

This is where precise interest rate hikes are used to curb inflation without pushing the economy into recession. But a successful soft landing is extremely rare, arguably achieved just once, in 1994.

So what they’re trying to do is raise rates enough so demand slows. So it’s really a tough needle that they’re trying to thread to get our economy in equilibrium. Now the question is, is there a way that they can apply the breaks that are enough to control inflation, but not enough to crash the economy?

Can we do a soft Landing?

And the truth is that that’s really, really difficult to get into that really, really narrow zone.

It’s the difference between trying to land an airplane in a really wide open field, versus trying to land an airplane on a very narrow piece of land with rocks and water on either side.

Some experts argue that policies have a clear limitation on what they can achieve against an impending downturn.

Policy tends to operate with long lags. I also think that increasingly we live in a global economy where the cross-currents that are impacting the economic dynamics are very complex.

These are dynamics that the Fed doesn’t have the tools to address. And so, you know, to a certain extent, we do think that policymakers have certainly developed more tools to fight recessions, but we don’t think that you can rely on policymakers to prevent recessions.

Signs of a 2022 recession, what happens to interest rates during a recession

There are several early signs of a recession that investors look out for. One tool that’s commonly cited is the yield curve, right? The yield curve inversion.

When the yield curve tends to invert, it means that people expect that the bond market expects interest rates to be higher in the short term than it does in the long term.

That’s because the Federal Reserve hikes rates to control inflation, and then after inflation is controlled, it cuts interest rates back down. So if you see that the market expects high-interest rates in the short term and low-interest rates in the long term, that’s indicative that a recession is coming, followed by an interest rate-cutting cycle.

A lot of people look at some of the manufacturing indices like the ISM Manufacturing Index.

When it tends to be above 50, that means that the economy is expanding. But when the ISM starts decelerating and approaches 50, a lot of people say, okay, the manufacturing side of the economy is going to contract, that that could be a recession indicator.

The third recession indicator that a lot of people look at is consumer confidence and suggest that, well, if consumer sentiment and consumer confidence go negative, that means consumers are going to pull in, take the credit cards away, and not spend. And that could cause a contraction in the economy.

How to protect your portfolio

A diverse portfolio can often provide the best defense. Diversify your holdings of assets to make sure that you’re including not only growth stocks but more value stocks and more defensive stocks.

Like health care, like the utility market. These are the companies that could manage through this process a little more effectively than some of the hypergrowth firms that are leveraging the credit market more so than a company with a ton of free cash flow and really strong balance sheets.

And that’s why I think there can be some value in recessions, not too deep and not too long, but in scenarios where we are overheating, assets have gotten way out of whack, and need to get to a point where they get back to fair value.

Should you be a stockpicker when a recession occurs?

It also creates opportunities to be a stockpicker. It’s very hard to buy stocks in a bull market, but very often recessions and the bear markets that come with it create brief opportunities to really reload your portfolio, to buy the stocks that you’ve wanted to own, essentially at sale prices.

But whether recessions are actually good for the economy remains widely debated. Look, recessions are very healthy things for the economy because ultimately recessions flush out excesses.

what happens to interest rates during a recession

So you think about it, when we have a recession, it reduces whatever extreme bubbles may have built up. I think that’s ridiculous. This notion that somehow we need to cleanse the system and the recession is a cleansing thing.

It is like saying everybody should have a heart attack once in a while. it’ll make them eat better and exercise more. It’s just not true.

You know, recessions cause job loss, and every job loss is enormously unfortunate. Becoming unemployed has enormously disrupted people’s lives. It causes enormous pain for families, households, for communities. It’s terrible. For Americans, understanding how recession works can best help them prepare for whatever may lie ahead.

Dynamics of a 2022 recession

Understanding the dynamics of a recession, allows you to potentially be more opportunistic, and protective of your wealth should these downturns happen.

Knowing that it may be coming can help you think through decisions about:

Do you want to buy a house or do you want to rent one? Do you want to take a new job or do you want to maybe wait because the job market may soften up? These are all things that, if you possess the knowledge of the business cycle, can help you manage your financial life in a much better way.

Hope you understand now what happens to interest rates during a recession. see ya in the next post 🙂