Introduction

In the world of trading, various technical indicators and strategies are used to gain insight into market trends and make informed decisions.

One such indicator is the volume-weighted average price (VWAP). The VWAP is a popular tool that traders can use to determine the average price at which a security traded during the day, taking into account the volume of each trade.

In this article, we’ll go over the advantages and disadvantages of VWAP for beginners and help them understand its importance and possible drawbacks.

Table of contents

What is VWAP?

Before we get into the pros and cons, of understanding the VWAP, it’s important to know what VWAP means.

VWAP is calculated by multiplying the price of each trade by the corresponding volume, summing these values, and dividing the result by the total trading volume within a given period.

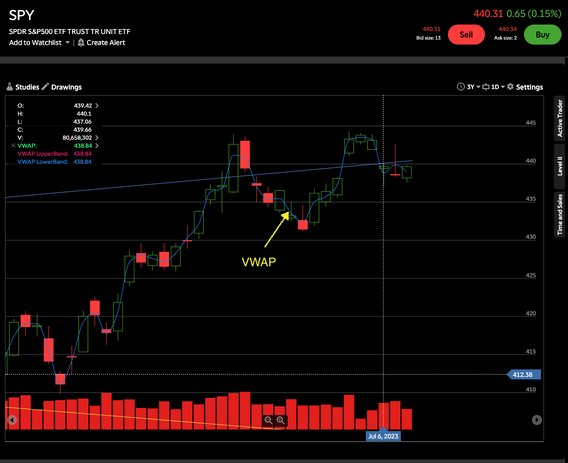

This calculation produces a weighted average price that reflects both price and volume. The VWAP is usually displayed as a continuous line on a trading chart so that traders can compare the current price with the average price over a given period.

The Pros of VWAP

- Reflects institutional trading: the VWAP is often used by institutional traders to execute large orders without significantly affecting the market. By following the VWAP line as a beginner, you can gain valuable insight into institutional investor behavior.

- Better trade execution: the VWAP helps traders evaluate the quality of their trades. By comparing the executed price to the VWAP, traders can determine if their execution was favorable or unfavorable. This information can help refine entry and exit strategies.

- Identifying market trends: the VWAP can serve as a reference point to identify market trends. If the price is consistently trading above the VWAP, this indicates bullish sentiment, while trading below the VWAP indicates bearish sentiment. This can be useful in determining the overall market direction.

- Intraday Support and Resistance: The VWAP can serve as a dynamic support and resistance level during intraday trading. Traders often observe price reactions near the VWAP that provide potential trading opportunities.

- Confirmation tool: the VWAP can be used in conjunction with other technical indicators to confirm trading signals. When multiple indicators are in line with the VWAP, it increases confidence in the trading setup.

The Cons of VWAP

- Lagging indicator: VWAP is calculated based on historical data and is, therefore, a lagging indicator. It may not provide real-time information on market conditions, which may be a disadvantage for traders seeking immediate insights.

- Limited applicability: while the VWAP is very useful in certain market conditions, it may be less effective in very volatile or illiquid markets. Extreme price movements or low trading volumes can distort the accuracy of the VWAP line.

- Overemphasis on volume: the VWAP places great emphasis on trading volume. In markets with sporadic or misleading volume spikes, the VWAP line may not accurately represent the average price.

- The inflexibility of time frames: VWAP calculations are typically based on a specific time frame, such as the trading day. This fixed time frame may not meet the needs of all traders who prefer shorter or longer time periods for their analyzes.

- Lack of context: even though the VWAP provides insight into the average price, it may not provide a complete picture of market dynamics. Other factors such as news, economic data, or geopolitical developments can significantly influence price movements that the VWAP may not capture.

How to use VWAP

Understanding the VWAP

Most platforms have the VWAP indicator, which is usually displayed as a moving average trendline. It’s important to check the indicator on your specific brokerage charting platform as part of the ‘Setting Instructions for Your Charts’.

The typical time frame is intraday and starts with the opening trade. Remember that the VWAP works best when there is a lot of volume.

Most charting platforms usually offer the VWAP indicator in the charts.

Conclusion

As a novice trader, understanding the VWAP and its advantages and disadvantages can be helpful in developing trading strategies.

The VWAP provides valuable insight into market trends, trade execution quality, and intraday support and resistance levels. However, it’s important to be aware of the limitations of the VWAP, such as its lag time, limited applicability, and potential overemphasis on volume.

By considering the pros and cons of the VWAP, beginners can make informed decisions and effectively incorporate this indicator into their trading arsenal.

As with any technical tool, it’s recommended to combine the VWAP with other indicators and adapt its use to your own trading style and preferences.