I’ve used three strategies for selling options that have given me a win rate of over 80%,

Since the beginning of this bear market. In this article, I’ll teach y’all about these strategies by explaining the basics.

I will show you a concrete example for each strategy and at the end, we’ll discuss the advantages and disadvantages.

Table of contents

- How to Sell Options for Income

- The Ins and Outs of Selling Options

- 1. Credit spreads

- Bear Call credit spread and Bear Put credit spread.

- Generate income from spreads

- 2. The wheel strategy

- Selling options for Income

- 3. Leaps options

How to Sell Options for Income

Strategies for selling options can be more lucrative and profitable than you thought. This strategy is a very good way for investors to be wrong about market directions and gain more profits. However, selling choices may be complicated. Is selling options an effective way to generate money or earn more money? This article will show you the different ways of making money and how you can use them wisely and effectively.

Time decay is thus beneficial to options sellers and the price of options is lowered.

Options buyers are able to quantify the decrease in the price of an option,

due to time decay or the passing of time in the market. The term term “theta” describes an option’s underlying value that essentially increases each year when its price is decreased. The selling option is an effective strategy meaning positions will earn money as time decay increases.

The Ins and Outs of Selling Options

When considering options trading in stock exchange trading, it can be difficult to determine what strategy will suit you. Investors bullish could buy calls or sell a put, but bearish could buy a put or sell a call. It’s a common practice that options are purchased and sold. This article will show why options favor options sellers and why there are risks in selling options to potential buyers.

1. Credit spreads

The first and most popular strategy I used this year was credit spreads.

these are credit spreads with a low delta. The way a credit spread works is that you first buy and sell options of the same type with the same expiration date.

In credit spread, there are two types:

Bear Call credit spread and Bear Put credit spread.

Bear Call credit spread

A put credit spread is bullish if you believe that the stock will be above your specified strike price on the expiration date.

The call credit spread is the opposite,

it’s bearish and you believe the stock will be below your strike price on the expiration date.

As I said at the beginning, we buy and sell options of the same type,

and we want to make sure that the option we sell is more expensive.

This way we get a net credit from the trade instead of paying a debit. if you pay a debit,

that’s a debit spread that does the opposite. To make sure you get a credit on a call credit spread,

you should sell a call option with a lower strike price than the option you’re buying.

If you do a put credit spread,

You want to sell an option with a higher strike price than the one you buy.

The credit you get when you open this trade depends on the strike prices you choose and also on your expiration date.

The longer you set your expiration date, the more credit you’ll receive. When you open your credit spread,

the strike price depends on how far in the money (ITM) or how close to the money the option is.

This depends on the strike price in relation to the share price.

For a call option,

It’ll be in the money (ITM) and you’ll get more credit if the stock is below the strike price.

this is how the credit, the strike price, and the expiration date work together.

If I’m bearish on Spy next week,

I’ll go to the options chain and set my expiration date for next Friday, December 30,

and pick calls at the top because I’m bearish on the stock.

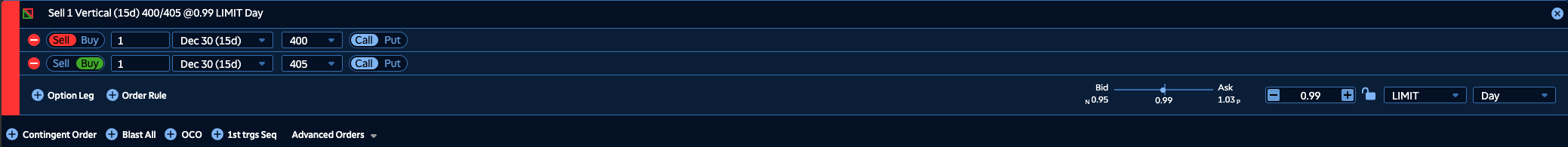

When I open a credit spread,

I want to make sure that the options expire out of the money. (OTM means the stock’s market price is above the option’s strike price) and that the option expires worthless.

I want low delta values because delta represents the probability that the option will expire in the money.

we want the opposite of that. If we look at this 400 call, it’s a delta of 27.

so there’s a probability of 27 that this trade will go against us

I think that the market will be pretty volatile next week (usually prices move between 20 and 30)

If I sell this call option, I expect SPY to fall below 400 by the expiration day on December 30.

What to do if you don’t have the underlying stock

Since I don’t have 100 Spy shares to sell,

I can use a long call option instead by buying another call option with a higher strike price.

The higher the strike price, the cheaper the option becomes,

so if I buy this 405 call option, I get 0.99 as an option premium.

My security for this trade is the difference between the strike prices, so 400 and 405.

If we only have a $5 difference, we multiply that by 100 and that’s the amount of collateral we need to open this trade.

We need 500 dollars in collateral and we get 99 in credits.

If we subtract that 99 in credits from the 500 in collateral,

our maximum loss for opening this trade is 401.

The maximum loss for this trade will be much greater than the maximum gain, which is just the credit we get from these 99

We want the odds to be in our favor so we can make a consistent income with this strategy.

I receive this credit as soon as I open the trade.

If the stock price rises, meaning goes against me and the spy is above 400 on expiration,

I lose money when my maximum loss of 401,

but if it performs according to my expectations or the spy stays below my 400 strike price,

I receive my maximum gain of 99.

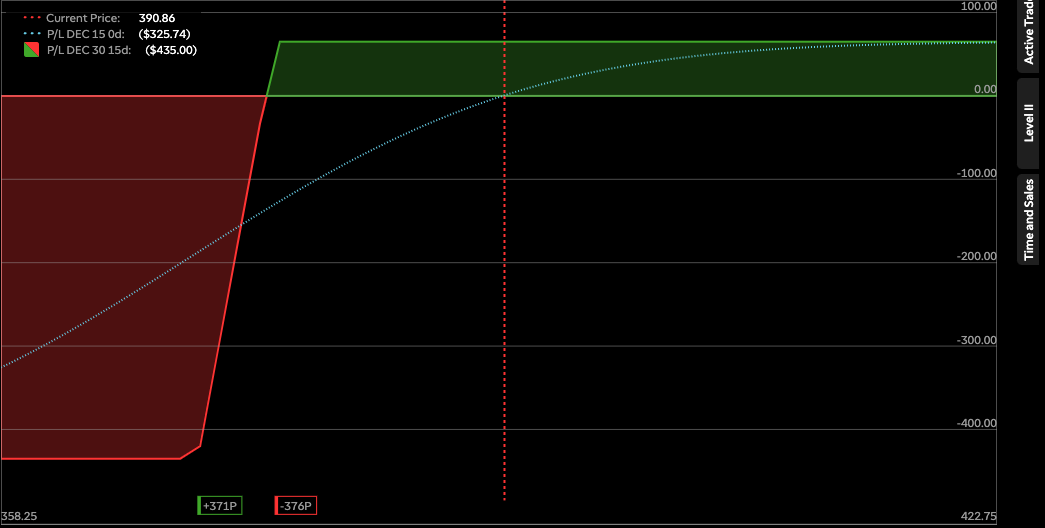

Bear Put credit spread

let’s assume that I’m bullish on Spy next week, so we’ll keep our expiration, assuming that’s our timing, and then we’ll do a put credit spread instead of opening a call credit spread, and that will work the same way as a call credit spread, where we’re looking at a delta of about 20.

Instead of buying a higher strike price, as we did with the call option,

we’ll buy a lower strike price because the lower the strike price when we open a put option,

the lower the premium.

We buy the call option 376/371 and the difference between the strike,

in this case, is only 5 dollars, so we deposit 500 as collateral.

Since the difference between our strikes is 376 minus 371 $5,

we multiply that by a hundred to get five hundred dollars in collateral,

and the credit we get if we open this trade here’s about 67 dollars. This means that our maximum risk for opening this trade.

If the stock price is below the strike price of 376 dollars, our maximum loss is 433 dollars if we open this trade and we’re wrong.

but if we’re right about this trade and the stock price (SPY) stays above 376 dollars until next Friday,

we get the full 67 dollars credit and you can also close these options anytime before the expiration date.

The advantages and disadvantages of Credit spread strategy.

let’s talk about the advantages and disadvantages of this strategy. The advantage of credit spreads is that they’re pretty consistent as long as you maintain a low delta. The lower your delta value, the more likely it’s that the option will expire out of the money and worthless

The lower your delta value, the more likely it’s that the option will expire out of the money and be worthless,

and the more likely it’s that you’ll receive full credit at the opening of the trade.

Generate income from spreads

If you open these spreads, which is one of the disadvantages, you can wipe out all the profits you made within a single trade. Therefore, it’s important to know when you’re wrong on a trade and be able to exit quickly

This strategy is well-suited for small accounts. You don’t need a lot of money to start using credit spreads. You only need the difference between the strike, i.e. if you’re a dollar difference between the strike prices, you only need a hundred dollars in collateral.

if you start with only a thousand dollars to trade options, this can be a really good strategy for you. The problem with this, however, is that if you don’t have enough to either buy or sell 100 shares, you’ll have to close your credit spread before it expires.

If you think the stock might end up between your strikes on expiration day, that’s called pin risk.

(pin risk is whenever your options both expire in the money at four o’clock and your broker starts exercising them and assigning them to you).

2. The wheel strategy

our next trading strategy is going to be the wheel strategy, the wheel strategy works in

Two parts: selling put -> assigned -> to sell a call options contract

It’s gonna start off by selling a put option and whenever you sell a put option, you commit to buy one hundred shares at the strike price that you choose. Then, once you are assigned to own those 100 shares at your strike price, you can use those 100 shares to sell calls against – that’s the second half of the wheel strategy.

when you sell a call option, you sell 100 shares at the strike you choose.

The credit you receive is higher the longer you set the expiration date because the stock may have higher volatility in a longer time frame and you get paid accordingly for taking that risk.

The further your option is ITM, the more you get because the option has intrinsic value, but you don’t want to sell options that are ITM. Typically, you want to sell options that are out of the money to reduce your chances of either buying or to sell 100 shares of your stock.

Can you make money on option premiums?

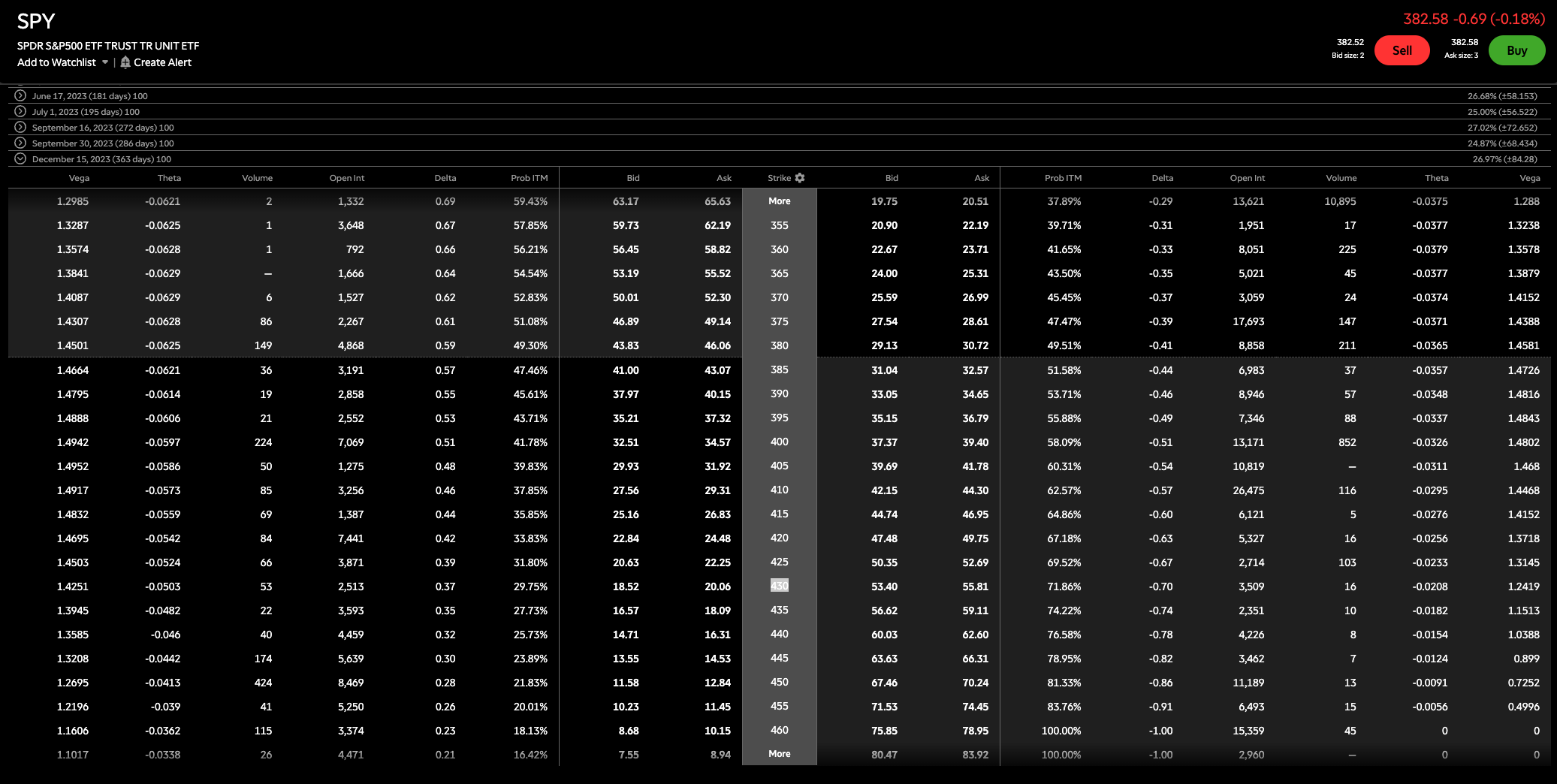

We come to our example. if I want to buy a hundred shares of SPY, currently trading for $390, I’d spend $39000 to buy 100 shares.

I wouldn’t get any money for it, and that’s the advantage of selling put options.

we’ll sell a put option to buy 100 shares of Spy and we’ll extend our expiration date for a better premium.

I will choose a strike that’s lower than the current market value. By doing so, I agree to buy one hundred shares of Spy at a small discount.

I need the money to make this trade i.e. I need 39000 in cash to make this trade and if I open it I will receive a premium in the form of a credit for taking the risk.

If the spy is above 380 of our sales strike on the expiration date, we can keep the money we received. We can keep the premium as a credit and then sell another put option further away from the expiration date.

When you sell a call option, you should choose a strike price higher than the current market value, and the way I choose my strike prices is exactly the same as with credit spreads

I like to look at delta values, the probability that the option will expire in or out of the money. this is the wheel strategy for you.

It starts by selling a put option and once you own 100 shares you can start selling call options against those 100 shares you own.

The advantages and disadvantages of the wheel strategy.

Now let’s talk about the advantages and disadvantages. The advantage of the wheel strategy is that you can decide for yourself at what price you buy and sell your shares

You can sell a put option at a lower strike price than the current market value of the stock, which means you’re committing to buy the stock at a discount.

The problem is that you’ve to buy those 100 shares if the stock falls above your strike price, and if the stock continues to fall, you lose money on those 100 shares of the stock.

the same is true for a cover call, if you own 100 shares and want to sell call options and the stock continues to fall, you lose money with the shares.

But if you sell the call option, you can agree to sell the stock at a higher price than the current market value, so you make a slightly better deal that way.

In order for you to sell your 100 shares, the stock must be above your strike price on the expiration date, which means you could’ve potentially sold it at a higher price, and with put options, you might’ve been able to buy the stock at a lower price if you’d waited it out. Another advantage of the Wheel strategy is that it gives you a good income – a really great strategy if you’re looking for extra income.

Selling options for Income

Selling options is slightly more complex than buying options and can involve additional risk. Here is a look at how to sell options, and some strategies that involve selling calls and puts. The ins and outs of selling options The buyer of options has the right, but not the obligation, to buy or sell an underlying security at a specified strike price, while a seller is obligated to buy or sell an underlying security at a specified strike price if the buyer chooses to exercise the option.

3. Leaps options

the next strategy I present is high delta leaps options. Leap stands for “long equity anticipation security.” These options have a longer expiration and more than a year to expiration.

It works the same way as a weekly or monthly option, which you’re probably used to, but again, the expiration is a year in the future.

You’re going to be bullish for a longer period of time, for a year instead of a few weeks, that’s how the jump works.

The longer you set the expiration, the more you have to pay to open your option because you’re giving the stock more time, which means that option will have higher volatility. paying more for your option the deeper you go in the money.

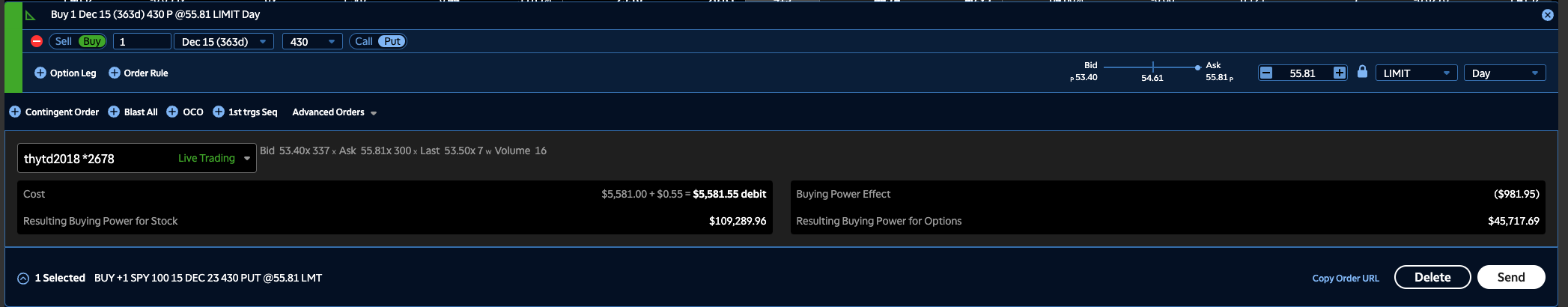

let’s go through a concrete example

If I’m bearish on Spy for the next year, I buy put options because I’m bearish on the stock, and I set my expiration to one year in the future, so December 15, 2023, and when I choose my strike price, I want to make sure that the odds are in my favor and that option expires in the money by looking at the delta values.

for a leaps option, I usually keep this value between 70 and 90

If we go for this 430 put, which has a delta of 70, I buy this put option, and right now it costs 55.81, which is my maximum risk

if the trade goes as I expect and Spy falls from 400 to about 350, this option would have an intrinsic value of 5000, which is the difference between the strike price of my put option and my target price.

and I’m paying $5581 thousand dollars in order to open this.

The advantages and disadvantages of leaps strategy.

The advantages of jump options are that you have plenty of time for the stock to move in the direction you choose, but the problem is that you pay more for the extra time value and thus have more to lose if you’re completely wrong about the trade.

If a stock just continuously goes against you then if it goes out of the money and expires out of the money then you lose everything that you put into the option but at the same time if the stock goes in your favor for a long period of time then you have more to gain out of that and one of the beautiful things about leaps options is that the risk is

pretty simple to understand you can only lose what you put into the trade.

there’s no early assignment risk or anything that’s associated with

selling an option so that’s the pros and the cons whenever it comes to a leaps Option.